Do You Know, Like, And Trust Your Property Investment Partner?

An Angel Investor's Guide to Property Development

You’ve got the cash. Property developers have the projects. But if you’re looking to invest without rolling up your sleeves and getting your hands dirty, you’re probably thinking, “How can I make money in property without breaking a sweat?” Well, the key is choosing the right developer to partner with.

So, before you rush in, let me ask you a few questions: Do you know, like, and trust the developer? Do you know, like, and trust their business? And often overlooked, do you know, like, and trust the deal? If you’re not sure how to answer those questions, buckle up because we’re about to go on a whirlwind journey through the essentials of hands-off property investment and selecting the right developer.

The First Question: Do You Know, Like, and Trust the Developer?

Let’s be honest, this is probably the most important part of the equation. If you wouldn’t trust someone with your dog, why would you trust them with your money? The developer is the person steering the ship, so you need to make sure they’re not going to steer you into an iceberg.

Transparency Is Key

When you’re investing your hard-earned cash, you need to know that the developer is going to be transparent. Ask yourself: Will they keep me in the loop? Will they provide regular updates, or will I be left in the dark until the project’s finished (or worse, sunk)? Transparency isn’t just about sharing positive information; it’s about sharing the good, bad and the ugly in a timely, honest and solution-based manner.

Do They Have Your Best Interests at Heart?

It’s easy for a developer to say they’ve got your back, but actions speak louder than words. Spend some time with them. Go beyond the usual “quick coffee” or zoom meeting. Take them out for a round of golf or a friendly game of padel, for the less adventurous, why not go to your favourite dinner spot? The goal is to spend time together outside of a business setting. This is how you truly get to know someone. Seeing how they act when they’re relaxed can give you an insight into their real character.

Remember, property development is a marathon, not a sprint. You’re going to be involved with this person for a while, so make sure they’re someone you feel comfortable with and someone you actually like. If they treat the staff at the golf club poorly or they’re the type to ghost you after the first big issue arises, then it might be time to rethink your partnership.

The Second Question: Do You Know, Like, and Trust the Business?

Now that you’re confident in the developer, let’s take a look at their business. Are they running a tight ship, or is it a leaky boat held together by rusty nails and wishful thinking?

Track Record Talks

Past performance may not be an absolute guarantee of future success, but it can give you a pretty solid hint. Ask to see their completed projects. Do they make you feel warm inside, or do they look like something you wouldn’t want to touch with a ten-foot pole? Check out the business’s track record. Have they been consistent in delivering quality, or are they known for over promising and under delivering?

Solid Financials Are Sexy

Okay, we’re not talking about taking them on a date, but have you seen their balance sheet and assets & liabilities? You don’t have to be Warren Buffett to know that a solid financial foundation is essential. Is the business swimming in debt, or do they have a healthy mix of assets and manageable liabilities? A well-run business should have financials that give you confidence, not sweaty palms.

The Third Question: Do You Know, Like, and Trust the Deal?

You’ve checked out the developer, given the business the thumbs-up, and now you’re left with the most crucial piece of the puzzle—the deal itself. After all, this is where the money is made (or lost).

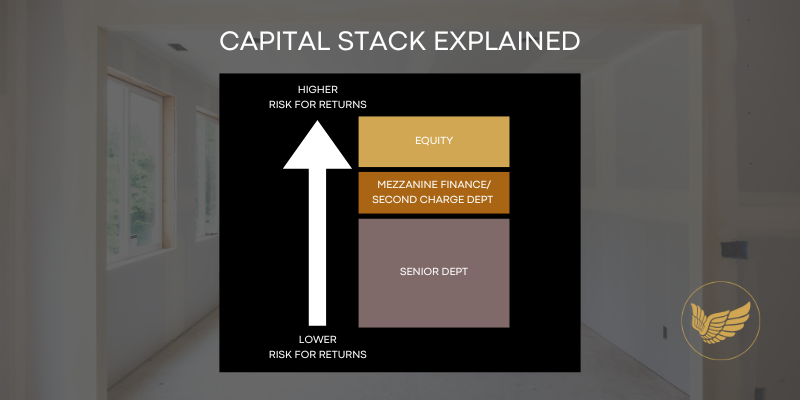

Understanding the Numbers

Even if you’re a hands-off investor, it’s still essential to understand the numbers at a high level. Start by asking the developer to walk you through the deal. Do you know the expected return on investment (ROI)? Is the projected profit margin big enough to cover unforeseen costs and still leave you and the developer with a decent slice of the pie?

Remember, it’s not just about you making money, it’s about ensuring that everyone wins. If the developer isn’t making enough profit to keep them motivated, the project might not get the attention it deserves. And let’s face it, no one wants to be stuck in a project that turns into a money pit because the developer’s enthusiasm ran out halfway through.

Risk, Contingencies, and Exit Plans

Let’s talk about the elephant in the room: Risk. No investment is without it, but you need to know what risks you’re facing and what’s in place to mitigate them. Ask the developer about their contingency plans. What happens if the costs overrun? Is there a cushion built into the budget, or are you on the edge of a financial cliff?

What is the exit strategy if things don’t go as planned? A well-prepared developer should have more than just a “cross your fingers and hope for the best” approach. They should be able to present you with multiple exit strategies, each one designed to protect your investment even in a worst-case scenario.

Always Remember: Know, Like, and Trust!

When it comes to angel investing in property development, knowing, liking, and trusting the developer, the business, and the deal are absolutely essential. These aren’t just feel-good words, they’re your guiding principles!

So, here’s the takeaway: Don’t rush in. Take your time to build a relationship with the developer. Dive into their business’s track record. Run the numbers on the deal, and always ask about the risks and contingency plans. If everything checks out, congratulations! You’re well on your way to being a hands-off property investment pro. Just remember, if you can’t answer “yes” to knowing, liking, and trusting any part of this process, you might want to think twice before signing that check.

And hey, if all else fails, at least you’ve spent some quality time on the golf course, right?

By Max Rayner

CREDITS

Max Rayner is the Director of Stuart Clinton Property, focusing on housing the UK’s most vulnerable people.

Stuart Clinton Property develop award winning Care Homes and Supported Living schemes across the UK working closely with high net-worths wanting to make a difference.

https://stuartclintonproperty.co.uk

https://www.thesupportedlivingplatform.co.uk

FOLLOW THE INITIATIVE

Step 1: Follow the initiative to watch it progress

Step 2: Receive your invite to join the ANGELS NETWORK to unlock access.

Top Picks

MORE ARTICLES