Not All Property Developers Are The Same

Can They Make Your Money Work?

Not everyone is the same. This simple yet profound statement applies to all industries, but none more so than the property sector, where the investment landscape is one of the most fragmented industries I’ve known. Property investment, as accessible as it may seem, comes with a range of risks and complexities. The phrase “Anyone can be a property developer” floats around with surprising ease. The truth is, while anyone with the funds can indeed buy a property, not everyone can execute the entire development process successfully, much less guarantee a return on investment.

With little regulation in place, the barriers to entry in the property development world are low. This lack of oversight means that the person sitting next to you could very well be a property investor. But the critical question is... are they qualified to take your money and provide you with a guaranteed return, with the interest agreed upon, and on time? The unfortunate answer is that most aren’t. True, anyone can call themselves a property developer, but only a handful have the experience, foresight, and skillset to successfully complete projects and return investor funds with a profit.

The Challenges Of The Property Development Sector

Let’s be frank: not everyone can make money in property development. It’s not simply about buying a run down property and sprucing it up. To make a project profitable, the process often involves an intricate dance of market knowledge, financing and refinancing, compliance and planning, budgeting, time management and negotiation. Most property developers are really good at only some aspects, almost never are they good at all of it, which is why you're never really working with just one person. You must consider the capability of all partners and services involved before you decide to park your money with them, even for just a short period. What you often find are developers who overpromise but underdeliver, some end up losing money for themselves and for their investors.

Not every project yields a profit, and it’s rare that a developer can guarantee they will pay you back in full, on time, with interest. This risk inherent in the industry can make navigating the property sector challenging for high net worth and sophisticated investors looking for a stable return. As an investor, you need to understand that while the allure of property is strong, the devil is in the details. With the current fragmented market, the differentiator often boils down to the individual developer and their abilities.

The Differences Among Developers

From the outset, every property developer might appear to be the same. Most property developers didn’t start their careers in property. It’s a field where backgrounds vary significantly - I have met developers move into the property profession from backgrounds in finance, law, construction, architecture, while others may come from seemingly unrelated fields like, catering, retail, education and even farming.

The key point is that these backgrounds create varied skills and capabilities. Many developers bring invaluable transferable skills from previous careers that serve them well in property, whether it’s strategic thinking, project management, or negotiation skills. Others have managed to thrive because they’ve somehow managed to stick at it for long enough to gain valuable learnings through sweat and scars. They have the bruises and experience that come from projects that went sideways, and that learning has turned them into seasoned developers who can spot trouble before it arises.

Then, there are those who have invested heavily in marketing to create an impressive façade of success, even if the track record in reality doesn’t match up. Conversely, some developers have a track record of completing successful projects but are not good at telling their story because they don’t have experience in marketing or simply don’t understand how to communicate their achievements effectively. It leaves investors like you trying to differentiate between the marketers and the craftsmen - the developers who talk the talk versus those who can walk the walk.

Identifying The Right Property Developers

So, how do you tell the good from the bad? How do you identify a developer who is worth lending your money to for a fixed return?

Track Record

One of the most critical factors is the developer’s track record, although be weary that past performance does not necessarily promise future success! You need a developer who can demonstrate a history of completed projects. Projects rarely are delivered on time and within budget - it is how they navigated the problems and still paid back what they owed that matters most. The ability to replicate success across different types of developments and in various economic conditions is also a good indicator.

Financial Stability

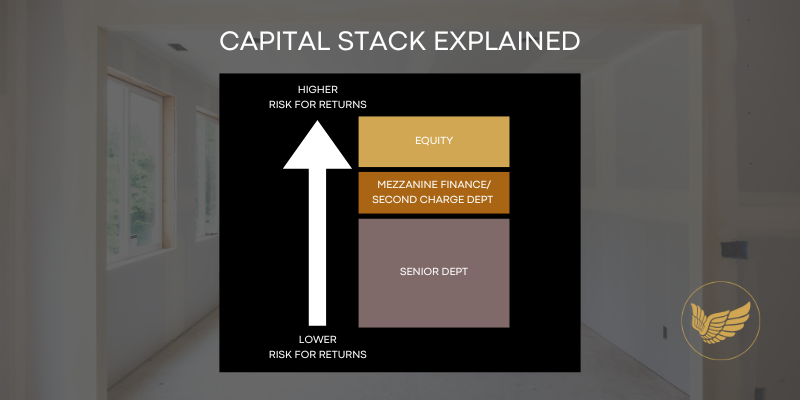

Excellent developers should have a clear understanding of financial planning and risk management. They should be able to show you their plan for financing the project, as well as contingency plans if things don’t go as expected.

Communication And Transparency

Transparent communication is non-negotiable. Developers should be willing to share their progress, answer questions, and be upfront about potential risks and issues. Avoid developers who are evasive or who fail to provide clear, concrete information. Trustworthy developers will provide detailed reports, updates, and realistic timelines.

Market Knowledge

Property development isn’t just about buildings and interiors, it’s about creating something that will be in demand. The right developer should have a deep understanding of the local market, including current trends, potential opportunities, and threats. Their projects should be located where the demand will be, not just where properties are cheapest to add value where they will not be valued.

Professional Relationships

An excellent developer often has strong relationships with reliable contractors, architects, and local planning authorities. These relationships help streamline processes and mitigate risks. If a developer has a trusted network of professional partners, they’re more likely to deliver a successful project.

The Compatibility Factor

Let’s not underestimate personality and compatibility in this equation. Investing in property development is a mid to long-term relationship. You’ll want to work with a developer whose approach aligns with your own investment philosophy. Some developers are aggressive, looking for the highest returns with higher risks, while others are more conservative, focusing on steady, predictable gains. Compatibility between your risk tolerance and the developer’s strategy is crucial for a successful partnership.

There are developers out there worth proactively seeking and backing, but the process requires time, effort, and due diligence. The question becomes - is it worth the hunt? The answer is often yes, under the right circumstances and given that the returns from successful property developments can far exceed those from more traditional forms of investment.

The Viable Strategy Of Private Lending

Private borrowing, often referred to as building a property portfolio using “other people’s money”, is not just a buzzword. It is a viable, tangible strategy that can generate fixed returns for the conscious investors. However, it’s also one that needs to be navigated with care. It’s critical to know exactly who you’re lending to, their track record, and their ability to execute a project effectively. Some developers have genuinely learned how to make this work for everyone involved - themselves, their contractors, and their lenders.

The goal here is to find the developers who have the ability, experience, and honesty to make their projects succeed using your money. They have a proper appreciation of the funds entrusted to them and manage them as prudently as their own. These developers are committed to building not just properties but long-lasting relationships with investors like you.

Are You Ready to Back the Best?

The property development world may be full of players, some good, many not so good, but the trick lies in finding the right people to back. Excellent developers are not in abundance, and identifying them takes both skill and patience. But for those willing to do the work, there are opportunities out there that can offer not just a fixed return but a rewarding partnership.

Watch this space. If you’re prepared to go on this journey, you may meet the developers I believe are truly worth your backing in the Angels Network, all for very good reasons, albeit some for different reasons depending on your risk appetite. Whether you are a seasoned investor or exploring the property sector for the first time, remember this: not everyone is the same. And finding the few who stand above the rest can make all the difference.

By Helen Turner

CREDITS

Written by Helen Turner, founder of PropertyAngels.Life - an initiative to accelerate the supply of adequate rental stock for the UK property market by helping high net worth individuals (HNWI) & sophisticated investors to find private lending and property investing confidence faster.

Go to the ABOUT page to read more on the initiative.

FOLLOW THE INITIATIVE

Step 1: Follow the initiative to watch it progress

Step 2: Receive your invite to join the ANGELS NETWORK to unlock access.

Top Picks

MORE ARTICLES