A Guide To Legal Charges, Security, And Step-In Rights In Private Lending

Property Law Protecting Your Investment

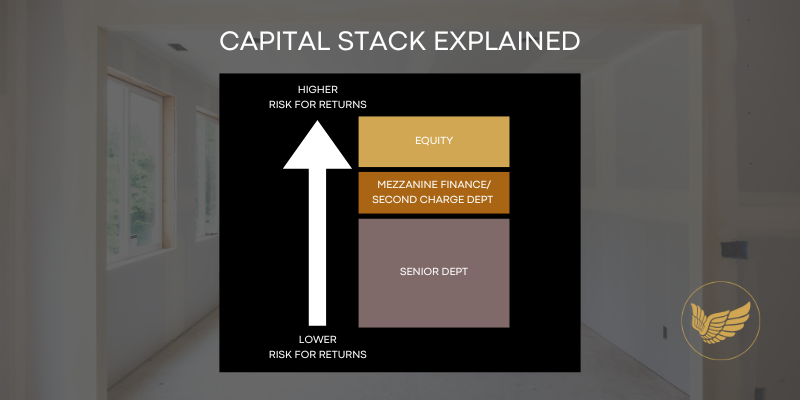

In property law, securing loans through legal charges over a property is a common practice. The distinctions between a first legal charge and a second legal charge are significant, particularly concerning priority, rights, and associated risks. Additionally, the concepts of negative pledges, step-in rights, and the appointment of Law of Property Act (LPA) receivers add layers of complexity to these financial arrangements.

This article explores these elements to provide a comprehensive understanding of property charges and their implications for borrowers and lenders.

First Legal Charge

A first legal charge, or first mortgage, is the primary security interest in a property, typically held by the main lender who can be a private institution like a bank or another business providing a loan note, or a person lending private capital. The first charge provides the initial financing for the property purchase. Key aspects of a first legal charge include:

Priority And Rights

- Priority: The first legal charge takes precedence over all other charges or claims against the property. In the event of a sale or foreclosure, the holder of the first charge is entitled to be paid first from the proceeds.

- Rights: The lender with a first legal charge has substantial rights, including the ability to repossess and sell the property if the borrower defaults on the loan. This ensures a higher level of security for the private lender.

Risk And Interest Rates

- Risk: Because the first legal charge holder has the primary claim on the property, the associated risk is lower compared to subsequent charges.

- LTV: If the loan value ratio to the value of the property is high the lender is still exposed to a significant amount of risk if the borrower defaults or there is an issue with the property or project that the charge is secured against.

- Interest Rates: Loans secured by a first legal charge usually come with lower interest rates, reflecting the reduced risk for the lender.

Second Legal Charge

A second legal charge, or second mortgage, is a subordinate security interest taken out on a property that already has a first legal charge secured against it. This charge is used to secure additional borrowing. Characteristics of a second legal charge include:

Priority And Rights

- Priority: A second legal charge ranks below the first legal charge. If the property is sold, the proceeds will first satisfy the debt owed under the first legal charge. Only after the first charge is fully settled will the second charge holder receive any remaining funds.

- Rights: The rights of the second charge holder are more limited. They can repossess and sell the property if the borrower defaults, but their ability to recover the debt is contingent on the amount left after satisfying the first charge.

Risk And Interest Rates

- Risk: The risk for lenders holding a second legal charge is higher because their ability to recoup the loan depends on the property's value exceeding the amount owed under the first charge.

- Interest Rates: Due to the increased risk, second mortgages generally carry higher interest rates compared to first mortgages.

Negative Pledges

A negative pledge is a clause in a loan agreement that restricts the borrower from creating any additional security interests over the property without the lender's consent. This concept is particularly relevant in the context of second legal charges:

- Protection for Lenders: A negative pledge protects the interests of the first charge holder by preventing the borrower from diminishing the value of the collateral through subsequent charges.

- Borrower Restrictions: For borrowers, agreeing to a negative pledge means they cannot take on additional secured debt without renegotiating terms with the existing lender, potentially limiting their financial flexibility.

Step-in Rights

Step-in rights allow a lender to "step in" and take over the management or operation of a project or property if the borrower defaults or fails to meet certain obligations. These rights are crucial in complex financing arrangements, especially for high-value properties or projects:

- Risk Mitigation: For lenders, step-in rights serve as a risk mitigation tool. If the borrower defaults, the lender can ensure that the property or project continues to generate revenue or maintains its value.

- Borrower Implications: Borrowers must be aware that step-in rights can lead to the lender taking control of their property or project, potentially disrupting their plans or operations.

Appointment Of LPA Receivers

Under the Law of Property Act 1925, an LPA receiver (usually licenced insolvency practitioners) can be appointed by a lender holding a legal charge to manage and realise the property. This mechanism is particularly important for lenders as it offers an efficient way to recover debts:

- Lender Benefits: Appointing an LPA receiver allows the lender to quickly take control of the property, manage it, and sell it if necessary to recover the outstanding debt. This process is generally quicker and less costly than going through a court process.

- Borrower Consequences: For borrowers, the appointment of an LPA receiver means losing control over the property, as the receiver has the authority to collect rents, sell the property, and take other actions to satisfy the debt.

Legal Implications For Borrowers And Lenders

Borrowers

For borrowers, understanding these concepts is vital. A first legal charge provides primary financing with favourable terms but may come with restrictions such as negative pledges. Taking on a second legal charge offers access to additional funds but at higher costs and risks, and may require navigating the constraints imposed by the first charge holder. Awareness of the potential for LPA receivership and step-in rights is also crucial, as these can significantly impact their control over the property.

Lenders

Lenders must carefully assess the risks associated with both types of charges. A first legal charge offers more security and rights, often involving a thorough appraisal of the borrower’s creditworthiness and the property's value. Second charge lenders face higher risks and must compensate with higher interest rates. Negative pledges and step-in rights provide additional layers of protection, ensuring that the lender’s interests are safeguarded in case of borrower default. The ability to appoint LPA receivers is a critical tool for lenders to recover debts efficiently.

Conclusion

The distinctions between a first legal charge and a second legal charge over a property are fundamental in property law, influencing the rights, priorities, and risks for both borrowers and lenders. A first legal charge offers primary security and lower risk, making it more favourable in terms of interest rates and recovery rights. Conversely, a second legal charge entails higher risk and cost due to its subordinate status. Negative pledges, step-in rights, and the ability to appoint LPA receivers add further complexity, offering lenders additional security but imposing more restrictions on borrowers. Both borrowers and lenders must navigate these differences carefully to make informed financial and legal decisions.

By Gerard Davis

CREDITS

Written by Gerard Davis - LLB Solicitor and Business Development Manager at Talbots Law. Gerard is also Director of McCutchion Davis Properties Limited.

FOLLOW THE INITIATIVE

Step 1: Follow the initiative to watch it progress

Step 2: Receive your invite to join the ANGELS NETWORK to unlock access.

Top Picks

MORE ARTICLES