THE POWER OF THE FUNDING STACK

How Investors Are Maximizing Property Investment Returns

When it comes to investing, having flexible ways to fund new opportunities is key to success. If we

specifically consider property investment, one particular strategy that investors are snapping up is by

endorsing the use of a funding stack.

A funding stack - also known as the capital stack - is a financial structure that describes the layers of

funding used to finance investments, and most commonly; property development.

Consider a funding stack like a layered cake. Each layer represents a unique funding source,

individually contributing to a specific role, priority and level of risk. The purpose of a funding stack is

to help investors and developers make the most of their capital, whilst also reducing financial

commitments by diversifying risk.

Funding stacks can be complex, so understanding the intricacies of these structures is crucial for

investors. In this article, Marc Champ, Managing Director at Wharf Financial, describes the different

lending options available in the funding stack, and the advantages and disadvantages worth

considering.

Funding Stack: Equity and Debt

Before diving into the pros and cons, it’s important to understand how a funding stack works.

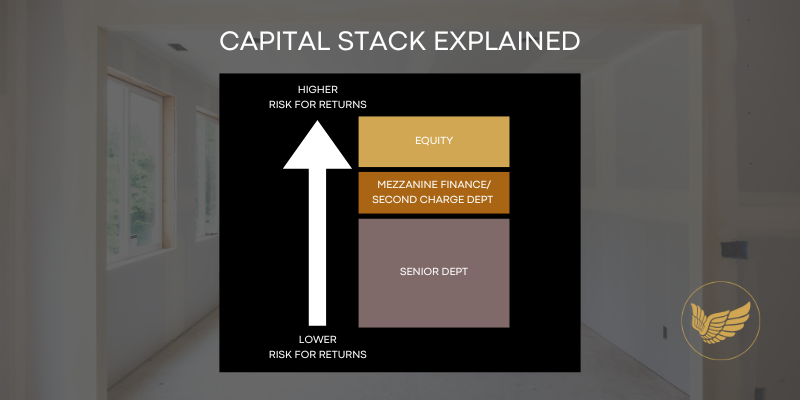

A typical stack has three layers; senior debt, mezzanine debt and equity, with equity at the top of

the stack followed by debt solutions. As investors with capital to deploy, how you’ll approach the

hierarchy of funding will depend upon its structure and your potential risk vs ROI.

By way of example, angels wanting to lend may provide funding (the debt) to a developer looking to

refurbish a derelict property. The developer will front the initial equity before looking for investment

to fund the rest of the project. Once the project is complete, the developer will most likely refinance

or sell the property for an increased value before repaying the angels’ capital and investment

returns.

Following an assessment of the opportunity, investors can decide how risky the investment is. If a

low loan-to-value loan is required (for example £100,000 against £1,000,000 i.e 10%) the

opportunity is deemed fairly low risk. However, if it is more risky, for example an 85% LTV

investment, you can either encourage the property developer to increase their equity - subsequently

reducing your loan amount - or reduce your exposure by bringing in other investors on an second

charge or mezzanine debt basis.

Equity investment is always at the top of the stack, followed by mezzanine or second charge finance

if required, then senior debt lending at the bottom. Debts are repaid from the bottom up.

Types of Finance In The Property Funding Stack

Equity Investment

In property development, equity is often provided by the developer(s) and forms the most flexible

part of the funding stack – much like a deposit. Typically, equity is raised via the developer’s own

funds or by attracting joint venture partners. It does not incur interest costs, but it does reduce the

overall ownership stake, sharing both the risks and returns of the investment.

Senior Debt

Senior debt loans typically make up the largest portion of the funding stack and use the property

itself as security. That’s why it gives investors priority in claiming the property if the borrower

defaults. This type of debt is considered the most cost-effective option due to its low-risk nature;

making it attractive for investors looking to explore buy-to-let, development or commercial

property.

Types of senior debt finance include:

- Development finance

- Refurbishment finance

- Commercial mortgages

- Mezzanine Finance

Mezzanine finance is a hybrid finance solution, often used to plug the gap between the senior debt

and equity. It holds a riskier position, therefore carries higher interest rates but enables equity

investors to access more capital with limited upfront funds.

For development projects where additional capital is needed beyond what a senior loan provides,

mezzanine finance is a popular solution.

Second Charge Loans

A second charge loan is another type of finance that sits behind the first charge. This type of loan

can be effective for short-term needs or value-add projects, but as they’re subordinated to senior

debt, have higher interest rates and carry more risk.

By combining these types of investment loans, property developers and angel investors can create

an optimised funding stack by balancing cost, flexibility, risk and projected ROI.

Risks Considerations of A Funding Stack

A funding stack is an essential tool for investors looking to diversify funds and maximize returns

when investing in property. However, while the funding stack can enhance financial flexibility and

reduce personal capital outlay, it also comes with distinct risks that investors should understand and

manage carefully. Here are four considerations for angels to consider.

1. Priority and Security Risks for Second Charge and Mezzanine Funders

In a funding stack where debts are prioritised by seniority, senior debt investors holds the most

important position as these funders will be repaid first if defaulting occurs. The other forms of debt,

like mezzanine finance and second charge loans, come after senior debt in terms of repayment

priority. As such, these types of debts bear risk for the funders, that’s why they come with higher

interest rates attached to them.

2. Economic Volatility & Market Risks

For investors deploying debt finance, economic volatility and market changes may cause the

borrower to suffer from cash flow management issues. Should this occur, borrower’s may struggle to

meet repayment obligations, subsequently impacting your investment and potential returns.

3. Over-Leveraging & Negative Equity

One of the biggest concerns of using a layered funding stack is over-leveraging. While leveraging

different types of debt can enable a borrower to control a larger asset base with less personal

capital, it also increases exposure to negative equity.

This presents a significant issue for investors. If we were to face a market downturn whereby

property values decline, an over-leveraged property stack could increase the borrower’s

vulnerability to negative equity, subsequently jeopardising investor funds. If the property is worth

less than the outstanding debt, it may become more difficult to sell or refinance. Having a situation

of negative equity can be challenging, especially when a borrower is compelled to sell assets because

of financial constraints.

4. Reduced Control and Authority Dilution

By becoming a debt investor, all partners usually agree to split profits and this can result in dilution

of returns. Furthermore, investors may not have a say in decision making which potentially limits

authority over the project. Such situations may lead to conflict if there are differences in project

strategies or financial objectives. Investment arrangements may also incorporate terms that give

precedence to preferred equity payouts, therefore influencing the profits available to other parties

involved.

Managing Property Funding Stacks

For angels considering investment in property, it is typically considered a robust investment and can

be highly lucrative if successful. By diversifying funds across different projects with multiple funding

stacks, angels have found this to be a popular way of leveraging multiple funding sources to

maximize returns.

To reduce the chances of encountering challenges, investors should not only be aware of the

possible risks, but also perform thorough research on the borrower, property, security and project

by carrying out sensitive due diligence and practical cash flow estimates.

Collaborating with expert property finance advisers who can assist in developing a strong financing

strategy is also key to success. By collaborating with market experts, the immediate financial need

can be identified with future investment objectives carefully considered, ensuring viable investment

plans are created for success. Reach out today to the team at Wharf Financial for more information.

By Marc Champ

CREDITS

Marc Champ is the The Property Finance Broker who sources the most competitive finance for property investors and developers.

With a comprehensive UNDERSTANDING of my clients’ lending requirements, I provide modern financial SOLUTIONS underpinned by an exquisite level of service.

My philosophy is to tailor financial packages to exceed the expectations of my clients. I help property investors & developers grow with quick, cost effective and professionally delivered financial solutions.

FOLLOW THE INITIATIVE

Step 1: Follow the initiative to watch it progress

Step 2: Receive your invite to join the ANGELS NETWORK to unlock access.

Top Picks

MORE ARTICLES