HMO Investment: Creating a Rolls-Royce of a Partnership

The Questions A Hands-Free Investor Should Ask

Investing in Houses in Multiple Occupation (HMOs) as a hands-free investor can be a smart way to generate passive income without getting involved in the project management of the refurb and the ongoing day-to-day management of the property. There are pros and cons to investing in property this way, and pitfalls for the unwary!

When I started to develop HMOs I needed the cash that a third party could provide in order to grow my portfolio. I was actively buying and developing HMOs but actively using my own money too. I had no previous experience of raising funds but over time I learnt about the different ways to raise and use investor finance and I began to understand what questions an investor typically asked. Later, I myself started to fund other people’s projects and saw the process from the other side of the fence, which gave me even more insight.

It helped me become more savvy about what I needed to communicate to a potential investor, and to understand the questions that I could be asked. I realised that too many people rush into investing without doing their due diligence and preparation which is a huge risk. The process of asking enough questions of your potential partner at the start will allow you to decide whether this is a good ‘match’ in terms of a business partnership. By learning how to do this, it enabled me to develop a lucrative portfolio of property that both myself and my investor benefitted from.

In this article I’ll share some tips for you if you are an investor looking to invest in HMOs without doing all the hard work yourself.

Define Your Objectives

The first step to is decide what is it that you are looking to achieve with your investment.

These could include:

- Better returns than you are currently achieving

- Leverage of another asset

- Long term growth strategy in capital assets

- Pension pot

- Ongoing monthly cashflow

- Knowledge and experience about HMOs

- Sharing risks with another person in property development

- Sharing the journey of building a portfolio with another motivated individual

Your strategy will be linked to your goals, and therefore clarifying these from the start is key to a successful path ahead. Your level of involvement in the process also needs to be considered as some strategies will require a more active approach than others.

There are many ways in which investors can work with those on the coal face of HMOs. These include:

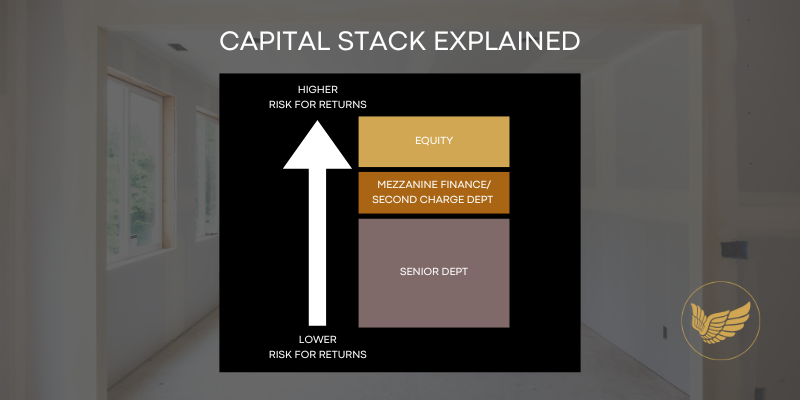

- A personal loan to an individual with a fixed return over a set period of time.

- A 50/50 Joint Venture (JV) partnership within a limited company or SPV (special purpose vehicle). Each partner holds 50% of the share capital within the limited company so all assets and liabilities are shared - as are the risks and the rewards. Consideration needs to be given to the treatment of equity introduced and withdrawn, and the roles and responsibilities of partners.

- An inter-company contractual partnership where two limited companies (or individuals for that matter) contract with each other to provide mutually beneficial services.

- An LLP partnership which is less formalised than a Limited company.

- Investing by way of a crowdfunding platform which gives you opportunity to invest in specific projects short-term.

- Investing in a REIT (Real Estate Investment Trust).

- Using a pension pot - normally a SSAS due to its nature and flexibility - to lend to others for their development and receiving a fixed cash return on the money lent.

When working with a third party provider, it’s critical from the start that you determine your preferred outcome. Not only will this help you to sift the wheat from the chaff when it comes to potential investment opportunities, it will also identify who are the right people to partner with.

Let’s imagine that you have a pot of money from a profitable business venture sitting in the bank. Right now you’re getting 4% interest at most. You know that the money is also being eaten up through inflation. It’s time to take action and step out of your comfort zone. You’ve heard about the great returns and cashflow that HMOs provide, and you know you have enough cash to do a few projects and build a sizeable portfolio. Where do you start? Who should you talk to? Who can you trust?

Networking and introductions are the best way to meet the right people to work with. Property networking meetings are typically full of developers or property investors looking to raise money! These kinds of informal settings allow you to chat with a variety of people and see who you naturally connect with. Stay in touch and check out their social media profiles and website to understand what experience and level of knowledge they have.

You might find there are a couple of people you want to follow up with and there’s nothing better than a coffee and a chat for this. At this meeting you might still want to keep your cards close to your chest in terms of what you have and how much you’re looking to invest, but this is a good chance to begin to explore options. If you feel that the meeting shows potential, then the next step is to consider to what degree you have a good match in terms of goals and values.

Due Diligence

When exploring a new business partnership, the level of due diligence you apply will depend on a number of factors such as:

- What length of time will you be in partnership together - is this a lifelong marriage or will you exit at a definite stage and date?

- What experience does your potential partner have in the field of HMOs? What previous projects have they done, and what were the successful and not so successful results?

- Who else have they partnered with and what do those others say about them?

- To what extent is your potential partner mindful of the rules and regulations around borrowing money for investing in ‘risky instruments’ and how do they manage these rules?

- How do they currently run and oversee the financial side of their property business? Do they have regular management accounts? What kinds of profits are they making?

- To what degree do you share the same values about business?

- What business partnerships have they had in the past which went wrong. What happened and why? What did they learn?

Too often, investors tend to jump straight into the potential results that they might gain, without exploring the ‘what if’s’ of the partnership. Yet these questions are critical to ensure you can create a healthy and mutually beneficial relationship.

In addition, I would expect to be asked some questions too.

The Financial Conduct Authority released a document in 2013 (13/3) which outlined their rules for ensuring that ordinary ‘retail’ investors were not scammed by investing in risky investments - and anything which is not FCA regulated is deemed risky - this includes property. The rules meant that anyone who is looking to raise finance from a third party who is as yet not known to them, needs to check out that the person is a sophisticated or High Net Worth investor. These restrictions were introduced to protect people from losing all their money in schemes which promised the earth - but as a result this needs to be taken seriously by property developers looking to raise money. Therefore your potential partner should be asking questions of you too to determine whether the structure you propose protects you both and meets the FCA regulations.

Once this initial due diligence is completed, I always start with an informal Heads of Terms document which begins the process of outlining a more formal proposal and agreement. From here it is then fairly clear what kind of structure to adopt.

The kinds of areas to cover in a Heads of Terms agreement include:

- Project Scope: The type and number of HMO properties to be developed or acquired.

- Investment Goals: Expected returns, timelines, and exit strategies.

- Roles and Responsibilities: Clearly defining each partner’s role especially in a JV (Joint Venture) scenario.

- Property Acquisition: Who will be identifying and purchasing suitable HMO properties? How will the properties be owned and paid for?

- Renovation and Development: Who is responsible for project management and who is responsible for financial management.

- Tenant Management: How will the HMO be managed once completed?

- Equity Shares (if relevant): How will these be treated? Proportional to each partner’s capital contribution or paid according to the performance of the HMO? How will original equity introduced be repaid?

- FCA regulations: how is the partnership ensuring these are reflected in the treatment of equity, risks and rewards?

You should also think about your exit strategy and discuss what this looks like to each of you.

Options might include:

- Property Sale: Selling the HMO properties and distributing the proceeds.

- Buyout: One partner buying out the others’ shares. Or the introduction of another investor into the business.

- Refinancing: Refinancing the property to release equity and distribute profits.

- Sale of the business

Creating a profitable, legal and compliant JV where you benefit from the tremendous opportunities offered by HMOs begins with good foundations. If you can adopt these methods and find the right partner with whom to invest, you never know you might be the Rolls to their Royce.

By Wendy Whittaker-Large.

Since 2012 Wendy has grown a multimillion pound property portfolio using other people’s money, mainly focusing on HMOs. She is an Amazon bestselling author, having written two books about investing in HMOs, and has been featured in the Sunday Telegraph, on BBC 1 and Channel 5. She regularly appears on the property speaking circuit across the UK.

Read more about Wendy in the Credits below.

CREDITS

Wendy Whittaker-Large is the founder of Best Nest - an award winning property development and lettings business, and HMO Success – her specialist HMO training and mentoring company.

She is the chair of the HMO Council Tax Reform Group who successfully overturned the single banding of HMO rooms for council tax in 2023, creating a historic win for the industry.

FOLLOW THE INITIATIVE

Step 1: Follow the initiative to watch it progress

Step 2: Receive your invite to join the ANGELS NETWORK to unlock access.

Top Picks

MORE ARTICLES