A Better Use For The £1.5 Trillion In UK Savings?

Could High-Net-Worth Savings Help To Close the Rental Housing Deficit?

The UK rental housing market is in a state of crisis, with a growing deficit in the availability of affordable rental homes. We often think of renters as students, young professionals or those who are in a vulnerable financial, mental or physical state, but the general population is renting for longer, and the rental demographic is getting older.

Only last summer, an FCA report published in July 2023 revealed that UK cash savers hold a staggering £1.5 trillion sitting in savings accounts. More recent Bank of England Credit data analysis conducted in January 2024 revealed that as much as £1.1 trillion of that cash is earning savers less than 2%, whilst £250 billion is earning nothing at all.

This sparks an argument for such a large sum of money that is not being circulated back into the economy in some meaningful way, seems unhelpful. Perhaps a portion of this vast pool of money that is earned, accumulated and held by high-net-worth individuals, could be leveraged to help close the rental housing gap?

While mobilising these savings could provide an excellent and viable solution, the challenges and risks involved would be wrong to neglect. Let’s explore further.

Direct Investment In Housing Development

One of the most straightforward ways to close the rental housing deficit is through the direct investment of savings into housing development and refurbishment projects. If even a fraction of the £1.5 trillion could be channelled into the development of new rental stock, it could make a significant impact.

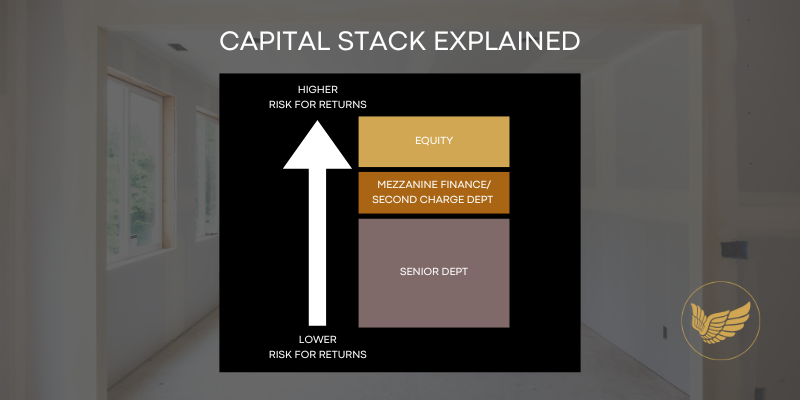

Private individuals, through direct lending to experienced property developers, could potentially earn higher returns than what their savings accounts offer while simultaneously contributing to the housing supply.

The argument here is rooted in the notion that the current typical return on savings is relatively low, especially when inflation is taken into account. By investing in housing and development, savers could potentially achieve better financial outcomes while addressing a critical social issue.

This could be particularly attractive in the context of the ongoing housing crisis, where demand for rental properties far outstrips supply, leading to skyrocketing rents and an affordability crisis. By creating a more favourable environment for private lending, a significant portion of the £1.5 trillion could be unlocked for housing projects, particularly development models which aim to repurpose existing, potentially unused commercial and residential properties, to make them appropriate for a specific rental market, or to cater an increased number of rental units.

The private lending approach could reduce the reliance on traditional bank financing, which has been constrained in recent years due to stricter lending criteria and a focus on more profitable ventures.

Initial Challenges And Barriers

Many potential investors don’t want anything to do with the actual property development process. Besides being updated on the progress and having a level of reassurance that the project will lead to the successful return of their money along with the pre-agreed interest. Without prior knowledge or experience in this field, this can leave people feeling less confident and less likely to explore opportunities. Investing into property with a hands-off approach, meaning that the lender puts in some or all of the money and another party does the work, may not be so straightforward because the money is not simply leveraged against a property’s value, you are also putting your trust into the people who will deliver a project.

So finding the right people to work with is essential for an optimal outcome. However, with the property industry made of a mix of experienced and more established professionals as well as thousands of individuals trying to make a living from property investments, the selection process can be daunting.

Liquidity And Risk Concerns

One of the primary reasons people keep money in savings accounts is liquidity. Savings accounts allow for easy access to funds in case of emergencies or unexpected expenses. Redirecting these savings into housing investments could reduce liquidity and increase financial risk for savers. Investing into the housing sector, whether through direct property purchases or lending to developers, generally comes with a fixed term of 12-24 months, making the cash illiquid for this period, and carrying the risk of illiquidity if the project takes an unforeseen turn. This could be particularly problematic for individuals who might need quick access to their funds.

The UK property market, although looking at the longer historical data, indicates stability and value increases, the more general housing market can be volatile if looking at some shorter periods, so the returns on investment are not guaranteed. Property values can fluctuate, and rental income can be unpredictable, especially in uncertain economic climates. This could lead to potential losses for savers, so they should be prepared for the associated risks.

Regulatory And Structural Barriers

The UK’s financial and housing markets are highly regulated, and any large-scale shift of savings into housing would require significant regulatory changes. For instance, the government would need to ensure that savers are adequately protected and informed about the risks involved. This could involve complex regulatory adjustments, which could be time-consuming and politically challenging.

Moreover, the current structure of the housing market may not be conducive to absorbing such a large influx of capital efficiently. There are already issues with planning permission, construction costs, and availability of land, all of which could limit the effectiveness of increased investment. Simply having more money available does not guarantee that it will lead to more houses being made available, especially if there are bottlenecks in the development process.

Economic Challenges

Despite an increase in property development activity creating more trades and employment opportunities, it takes time to train new skilled workers and an increase in demand for materials could push prices up further.

Conclusion

Individuals who intend on investing their savings with property developers should ensure that they understand and can afford the associated risks of loss. There’s a good argument that private capital being injected into the UK housing market could help close the gap in the adequate supply of rental stock, however it is not a quick fix and a sudden influx of activity could cause wider regulatory and economic challenges.

By Helen Turner

CREDITS

Written by Helen Turner, founder of PropertyAngels.Life - an initiative to accelerate the supply of adequate rental stock for the UK property market by helping high net worth individuals (HNWI) & sophisticated investors to find private lending and property investing confidence faster.

Go to the ABOUT page to read more on the initiative.

FOLLOW THE INITIATIVE

Step 1: Follow the initiative to watch it progress

Step 2: Receive your invite to join the ANGELS NETWORK to unlock access.

Top Picks

MORE ARTICLES