Is Your Property Developer Partner Borrowing Ethically?

What To Watch Out For...

I have previously spoken about knowing, liking and trusting your property developer which are the key pillars to all successful partnerships. But today I am going to dig deeper and explore the ethical side of borrowing, so get buckled up!

You’re all set to lend to a property developer on their latest project, picturing that sweet interest rolling in. But before you get too excited, there’s one vital question to ask yourself: “Is my developer borrowing ethically?” We’re not just talking about just timely repayments either, ethical borrowing is about so much more. Will they be transparent, offer security, act fairly and will they respect everyone in the process, including you? With this in mind, let’s dig into three key areas you need to have on your radar that will keep your investment safe and your conscience clear.

1. Transparency: Are They Keeping You in the Loop?

In any great partnership, communication is key. Whether you’re dealing with your life partner, best mate, or of course your property developer; clear and open dialogue and asking the right questions is essential. This is to ensure that you know where your money is going, how it’s being used, and that you’re never left in the dark.

What to Watch For...

Clear plans and timelines

Ethical developers should have a structured plan that shows how your investment will be used and when you can expect returns. If timelines keep changing or remain vague, consider it a warning sign.

Regular updates

A trustworthy developer won’t go radio silent after receiving your funds. They’ll keep you informed of progress, sharing both the good and the bad and what to expect if things change.

Financial transparency

They should provide financial reports that outline where funds are allocated. If they’re not sharing details or are vague about allocations, dig deeper.

Ethical developers make sure you’re informed every step of the way because that’s how trust is built. You wouldn’t lend a mate a grand without knowing why, so why part with hundreds of thousands if not millions without crystal clear communication?

2. Security: Is Your Investment Protected?

Trust is essential, but trust backed by security is even better. Ethical developers should have safeguards to protect your investment, ensuring that if things go off track, you’re not left in a vulnerable position. It’s about having a solid backup plan.

What to Watch For...

Multiple Exit Plans

Your developer should be able to explain an array of outcomes should the project not go to plan and have means of returning your money back to you should it go wrong. If there isn’t many paths then this should be considered higher risk!

Asset-backed security

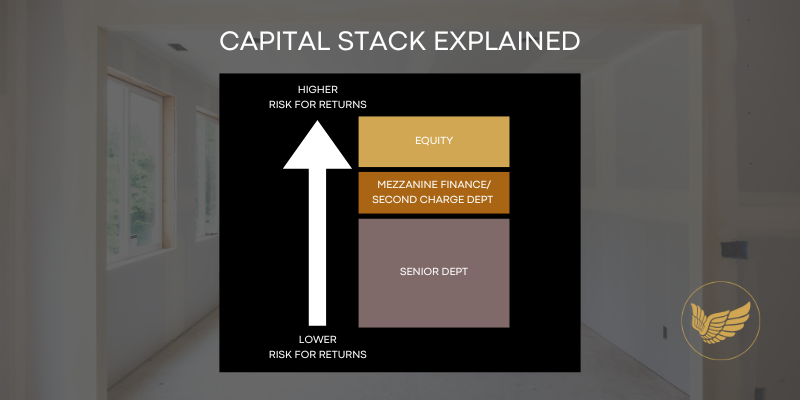

It is common practice for your loan where possible to be secured against real, valuable assets like property, land or the business. This ensures that if the developer can’t repay, you still have a way to recover.

Personal guarantees

If you are not happy with the level of security offered, you could also look to get a personal guarantee from the developer. Ethical developers tend to sign these more easily as a way of commitment show paying you back is a priority. A personal guarantee doesn’t always need to be signed but consider it if the developer is not putting any collateral in for themselves giving extra peace of mind.

A developer borrowing ethically will prioritise the security of your investment and ensure the risks are mitigated. They won’t leave you hanging if the project faces setbacks.

3. Fairness: Is the Deal Balanced?

Here’s the big one often not quite balanced in your favour—fairness! Both you and the developer are here to make money, but ethical borrowing means the terms and conditions benefit everyone involved, not just the developer. The rewards and risks should be shared fairly.

What to Watch For...

Reasonable returns

If returns seem too high to be true, they probably are. Ethical developers won’t lure you in with inflated promises; they’ll offer reasonable, achievable returns.

Risk-sharing

If your developer partner is ethical, they won’t place all the risk on you. Fair deals ensure both parties have a stake in the outcome.

Fairness is about more than just financial terms. Ethical developers also consider the environmental impact, local community welfare, and fair treatment of workers. If you get the sense they are cutting corners in the search for a quick buck and not thinking about the long game, then chances are, they probably are and not borrowing from you ethically.

So Watch Out, But Don’t Freak Out

Ethical borrowing boils down to these three principles—transparency, security, and fairness. When lending to a developer, you want to feel confident that your money is being used honestly and that everyone’s best interests are considered.

Sure, there are risks involved with any investment, but by asking the right questions and knowing what to look for, you can ensure you’re working with a developer who isn’t just borrowing to build properties but is doing it the right way. You want to sleep easy at night, knowing your money is safe, the deal is fair, and the project is contributing positively to the community and environment.

So, before you dive into your next property investment, ask yourself: Is my developer borrowing ethically? If the answer is yes, congratulations! You’ve likely found a solid, sustainable, and fair investment opportunity. If not, keep looking. Your money deserves better.

Happy investing!

By Max Rayner

CREDITS

Max Rayner is the Director of Stuart Clinton Property, focusing on housing the UK’s most vulnerable people.

Stuart Clinton Property develop award winning Care Homes and Supported Living schemes across the UK working closely with high net-worths wanting to make a difference.

https://stuartclintonproperty.co.uk

https://www.thesupportedlivingplatform.co.uk

FOLLOW THE INITIATIVE

Step 1: Follow the initiative to watch it progress

Step 2: Receive your invite to join the ANGELS NETWORK to unlock access.

Top Picks

MORE ARTICLES